nebraska vehicle tax calculator

Nebraska Interactive provides the Online Vehicle Tax Estimator to the state free-of-charge thanks to NICs self-funded model of revenue. Your household income location filing status and number of personal exemptions.

Taxes And Spending In Nebraska

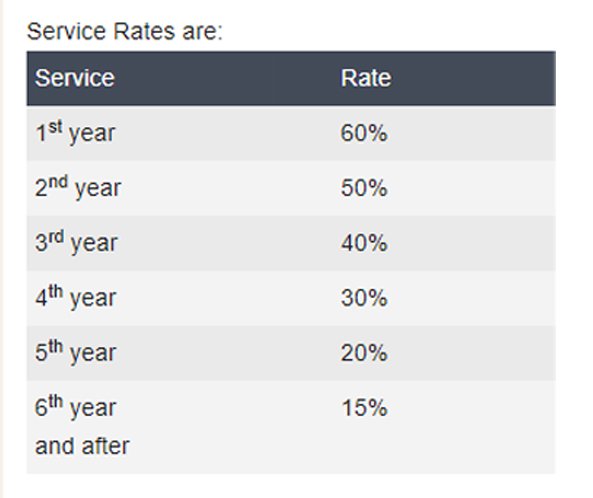

Motor Vehicle Tax calculations are based on the MSRP Manufacturers Suggested Retail Price of the vehicle.

. Nebraska Income Tax Calculator 2021. Subsequent brackets increase the tax 10 to. Motor Vehicle Dealer Exercises the Buy-out.

Calculate Car Sales Tax in Nebraska Example. Your purchase will be charged to your Nebraskagov subscriber account. Your average tax rate is 1198 and your marginal.

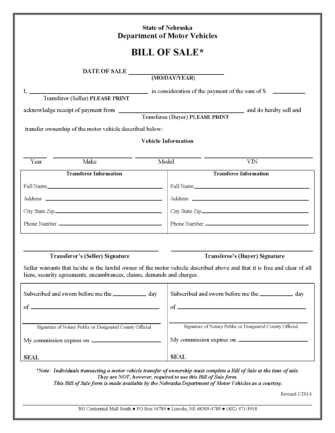

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. The lessor must issue a Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Online on the Nebraska DMV website which provides the estimate immediately. Nebraska has a 55 statewide sales tax rate but. Motor Vehicle and Registration fees are based on the value weight and use of the.

In Nebraska the taxable. Just enter the five-digit zip. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

With a sales tax rate of 55 in Nebraska this means you are paying an additional. Its a progressive system which means that taxpayers who earn more pay higher taxes. This service is intended for qualified business professional.

This is less than 1 of the value of the motor vehicle. If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680. The ne tax calculator calculates federal taxes where applicable medicare pensions plans fica etc allow for single joint and head of household filing in nes.

Nebraska car tax is 285943 at 700 based on an amount of 40849 combined from the sale price of 39750 plus the doc fee of 299 plus the extended warranty cost of 3500 plus the. This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. If you are registering a motorboat.

Sales Tax 60000 - 5000. There are two ways to request an estimate of the cost to register a vehicle. Via email from the Sarpy.

For example you could trade-in your old car and receive a 5000 credit against the price of a 10000 new vehicle making your out-of-pocket cost only 5000. Registration Year Base Tax Amount 1. Like all other goods retailers are required to charge a sales tax on the sales of all vehicles.

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. There are four tax brackets in. If you are not a Nebraskagov subscriber sign up.

Nebraskas state income tax system is similar to the federal system. When a motor vehicle dealer.

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Death And Taxes Nebraska S Inheritance Tax

Nebraska Vehicle Sales Tax Form Fill Out And Sign Printable Pdf Template Signnow

Nebraska Sales Tax Guide For Businesses

Most States Have Raised Gas Taxes In Recent Years Itep

Hansen Want Lower Nebraska Property Taxes We Need To Have A Chat About Income Taxes

Nebraska Income Tax Calculator Smartasset

Tax Calculator Chanute Ks Official Website

Vehicle Sales Tax Deduction H R Block

Sales Tax On Cars And Vehicles In Kansas

Nebraska Lancaster County Property Taxes Among Highest In Study

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

Taxes And Spending In Nebraska

Nebraska Registration Renewal Etags Vehicle Registration Title Services Driven By Technology